- TON is de afgelopen maand met 14,64% gedaald.

- De marktfundamenten duidden op een verschuiving in het marktsentiment, van bearish naar bullish.

De afgelopen maand heeft de cryptocurrency-markt een sterke rally gekend met Bitcoin [BTC] Het steeg naar een binnenlands hoogtepunt van $ 69.000.

De afgelopen week is de markt echter gekalmeerd, waarbij de meeste cryptocurrencies negatief zijn geworden. De recente verliezen beginnen dus groter te worden dan de maandelijkse winsten.

Een van de meest succesvolle altcoins is Toncoin [TON]. Sinds het maandelijkse hoogtepunt van $5,8 werd bereikt, heeft TON een aanzienlijke daling gekend.

Op het moment van schrijven handelt Toncoin zelfs voor $4,95. Dit betekent een daling van 2,42% over de afgelopen dag.

Op dezelfde manier daalde de altcoin met 14,64% op maandbasis, met een verlenging van deze neerwaartse trend met 6,06% op de wekelijkse hitlijsten.

Met name de heersende marktomstandigheden hebben ervoor gezorgd dat de cryptocurrency-gemeenschap zich heeft beraadslaagd over het pad van de altcoin.

Een van hen is de beroemde cryptoanalist [TON}. As such, since hitting a monthly high of $5.8, Ton has experienced a significant decline. In fact, as of this writing, Toncoin was trading at $4.95. This marked a 2.42% decline over the past day. Equally, the altcoin has dipped by 14.64% on monthly with an extension to this bearish trend by 6.06% on weekly charts. Notably, the prevailing market conditions have left the crypto community deliberating over the altcoin’s trajectory. One of them is the popular crypto analysts Ali Martinez who has suggested Ton’s current conditions provides buying opportunity. TON TD Sequential shows a buy signal In his analysis, Martinez posited that TD sequential shows a buy signal on Toncoin’s 12-hour charts. According to him, this suggests a potential price rebound in the near future. In context, what this means is that selling pressure is a warning and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices thus creating buying pressure. As the buy signal has appeared, it has resulted in increased trading activities. Thus, Trading volume for Ton has surged by 126% to $313.1 million on 24-hour charts. This suggests that most likely traders are entering the market buying at lower prices. Therefore, if the market follows through, the prices will rebound and see further gains on price charts. What Ton Charts Suggest Although Ton has experienced a sustained decline, the current conditions suggest bears have exhausted and the altcoin could see gains on price charts. For example, Toncoin’s large holder’s Netflow to exchange netflow ratio has declined from a monthly high of 289% to 70%. This shows a shift in sentiment with large holders accumulating their assets as they anticipate more gains. Such a decline suggests market confidence. Additionally, Toncoin’s Aggregated exchanges total outflows have increased from a low of 1.86 million tokens to 7 million Ton. This shows that most investors are withdrawing their Ton from exchanges to store in cold wallets. Such behavior suggests that investors are confident in the altcoin’s future prospects. Simply put, Ton is experiencing a shift in market sentiment from bearish to bullish. Therefore, if this sentiment holds, Ton will reclaim a higher level. Thus, the altcoin will attempt a $5.4 resistance level in the near term. A breakout from this level will see Ton reach $5.8. However, if bulls fail to take over the market, a further decline will see a drop to $4.02.” data-wpel-link=”external” target=”_blank” rel=”nofollow external noopener noreferrer”>Ali Martinez, who suggested that TON’s current conditions signaled a buying opportunity.

TON shows a buy signal

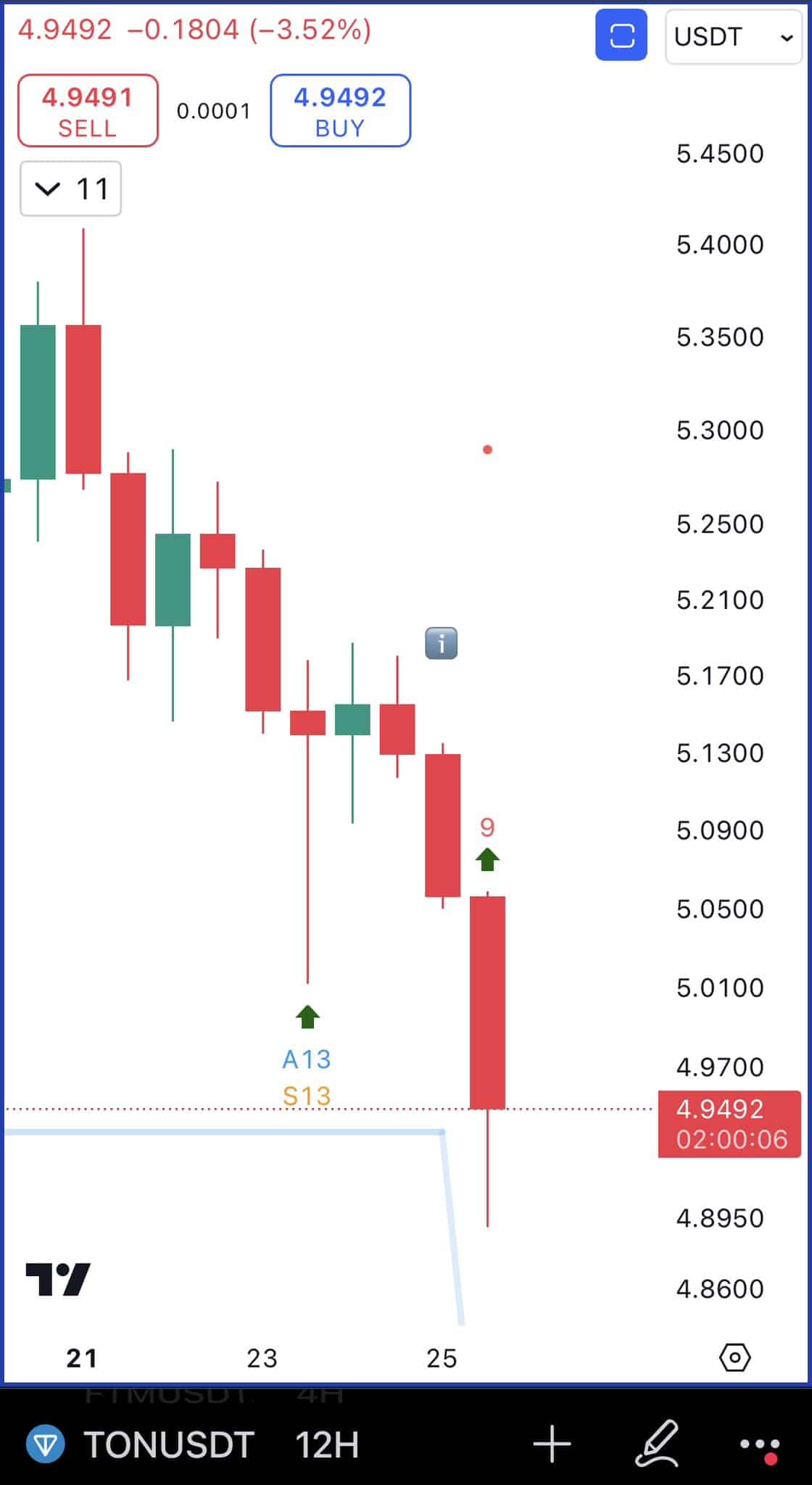

In his analysis, Martinez posited that TD sequential showed a buy signal on Toncoin’s 12-hour charts. This suggested a potential price rebound in the near future.

Source: X

What this means is that selling pressure is a warning, and the bears are losing momentum. When sellers lose momentum, buyers can enter the market at lower prices, thus creating buying pressure.

The appearance of the buy signal has resulted in increased trading activities over the past day. Thus, TON’s trading volume has surged by 126% to $313.1 million. Thus, most traders were entering the market at lower prices.

If the market follows through, the prices will rebound and see further gains on price charts.

Gains ahead?

Although TON has experienced a sustained decline, the current conditions suggested that the bears were, and the altcoin could see some gains ahead.

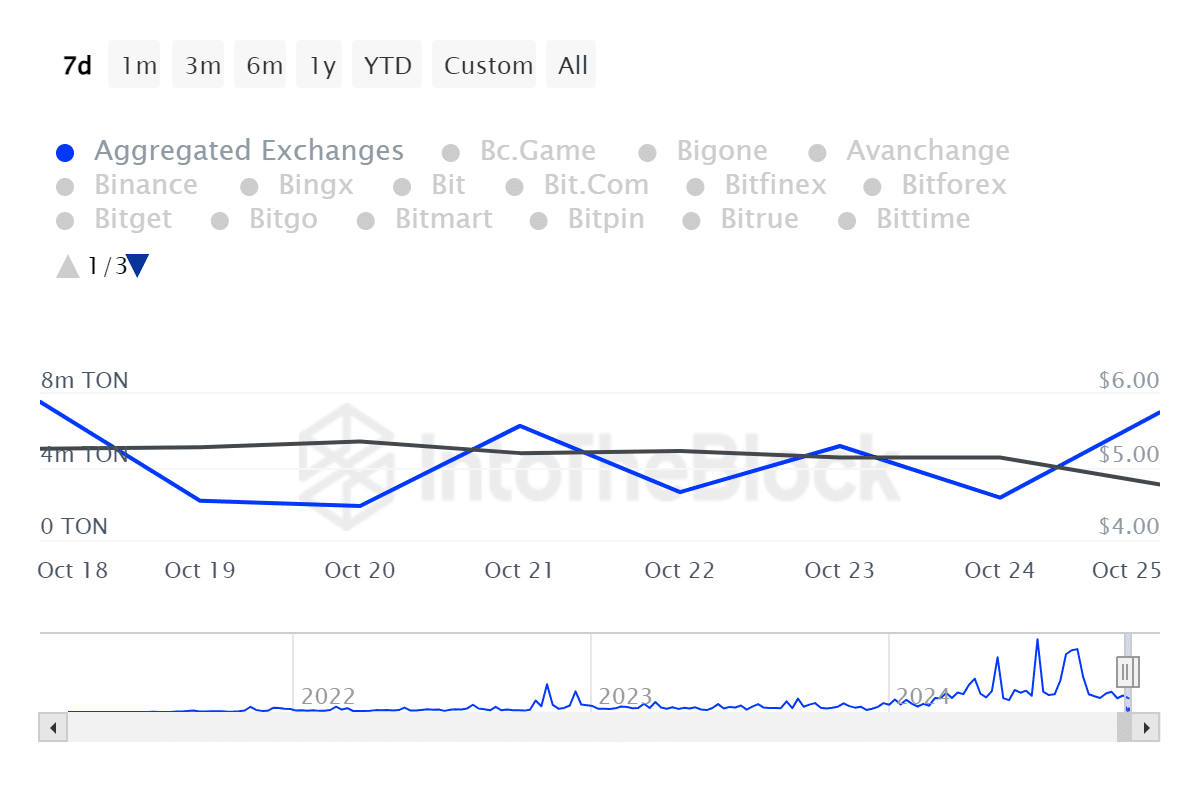

Source: IntoTheBlock

For example, Toncoin’s large holder’s Netflow Ratio has declined from a monthly high of 289% to 70%. This showed a shift in sentiment, with large holders accumulating their assets as they anticipated more gains.

Such a decline suggested market confidence.

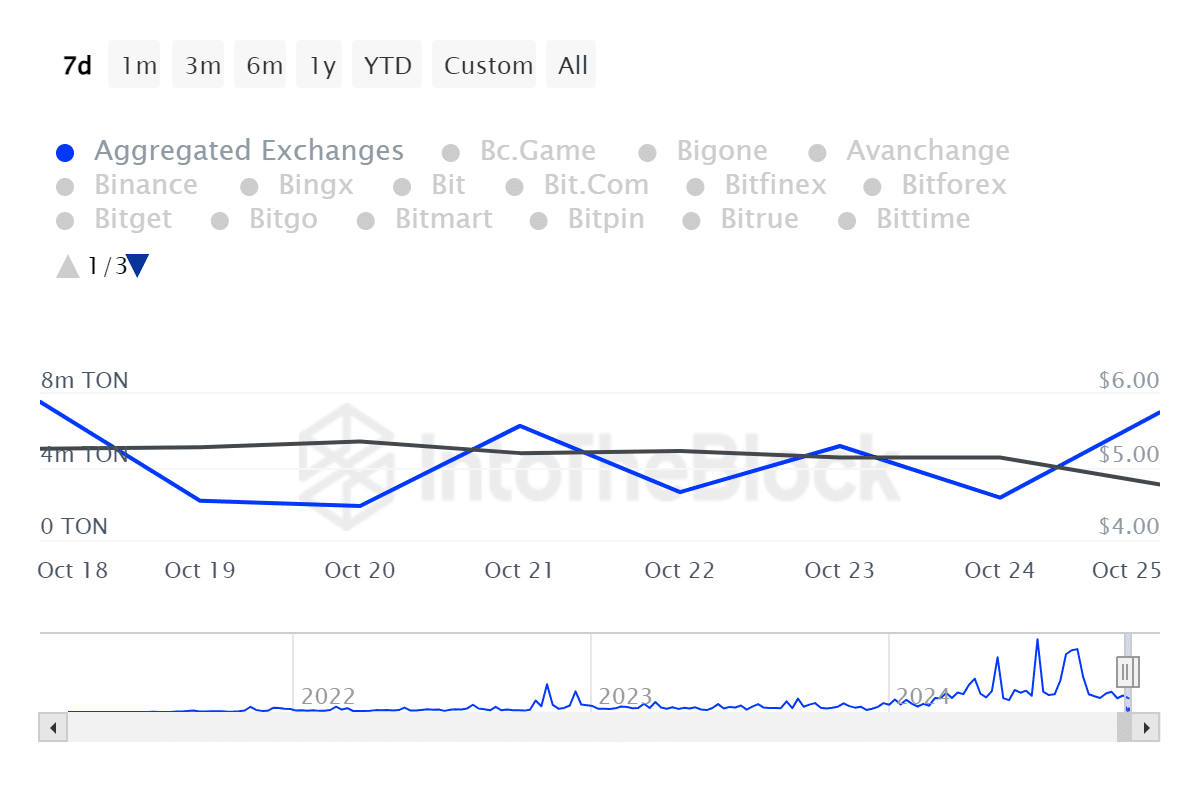

Source: IntoTheBlock

Additionally, Toncoin’s total outflows on Aggregated Exchanges increased from a low of 1.86 million tokens to 7 million.

This showed that most investors were withdrawing their Ton from exchanges to store in cold wallets. So, investors seemed confident in the altcoin’s future prospects.

Read Toncoin’s [TON] Prijsvoorspellingen 2024-2025

Simpel gezegd: TON zag op het moment van schrijven een verschuiving in het marktsentiment van bearish naar bullish. Als deze gevoelens aanhouden, komt Toon weer op een hoger niveau.

Daarom zou de altcoin op korte termijn kunnen proberen het weerstandsniveau van $5,4 te bereiken. Een doorbraak uit dit niveau zou de ton naar $5,8 brengen. Als de bulls er echter niet in slagen de controle over de markt over te nemen, zal een verdere daling ertoe leiden dat de TON daalt naar $4,02.

“Reizende ninja. Onruststoker. Spekonderzoeker. Expert in extreme alcohol. Verdediger van zombies.”

More Stories

Nu de omzet daalt, elimineert Starbucks de toeslagen voor niet-zuivelproducten

De waarde van de Canadese dollar daalt ten opzichte van de Amerikaanse dollar. Wie heeft er pijn?

Voorgestelde wijzigingen in de Crown Lands Act om de in het rapport van de AG genoemde kwesties te helpen aanpakken: Minister